ETAC

Carlyle European Tactical Private Credit Fund

About ETAC

Carlyle European Tactical Private Credit Fund (“ETAC”) is a European credit fund structured as an open ended, semi-liquid fund offering monthly subscriptions and quarterly redemptions. ETAC leverages Carlyle’s $188 billion Global Credit platform and seeks to provide current income and broad access to the European credit markets by strategically allocating capital across the credit spectrum. Under normal circumstances, the Fund will target investing at least 70% of its assets in private fixed income securities and credit instruments, primarily in senior secured and floating rate debt.

We believe private credit is a fundamental constituent within a well-diversified portfolio and can provide investors enhanced yields through market cycles. In launching this European private credit strategy for individuals, we are providing highly differentiated opportunities to an increasingly important investor base, enabling them to benefit from Carlyle Global Credit’s breadth of capabilities, scale of capital and its integrated global platform.

|

Taj Sidhu Head of European and Asian Private Credit |

Key Fund Facts

June 2018Fund Inception |

$2,029MM1Managed Assets |

8.65% / 7.84%2Annualized Distribution Rate |

1 Total AUM as of 9/30/22 represents managed assets including leverage (net assets of $1,328mm). Past performance does not guarantee future results.

2 As of 9/30/22 based on I share class. Represents income, capital gains and return of capital (if any) in the stated reporting period. Annualized distribution rate is calculated by taking the stated quarter’s distribution rate divided by the quarter-end NAV and annualizing, without compounding. Last Twelve Months “LTM” distribution rate is calculated by taking the total distribution rate over the period divided by the current quarter-end NAV.

3 Duration (Years) on Assets: Duration measures interest rate sensitivity; the longer the duration, the greater the volatility as rates change.

4 Level of Debt and Preferred Equity as a Percent of Total Assets.

Performance

11.80%Total Return Year-to-Date |

11.80%Total Returns since Inception (03 Jan 2023) |

$224.0MNet Asset Value |

$11.18Net Asset Value Per Share |

Performance of I shares as of August 31, 2023.

Past performance is not a guarantee of future returns. Returns shown net of all fees and expenses. The Fund pays a monthly management fee equal to 1.25% on an annualized basis of the Fund’s net asset value. The total expense ratio is 3.25%.

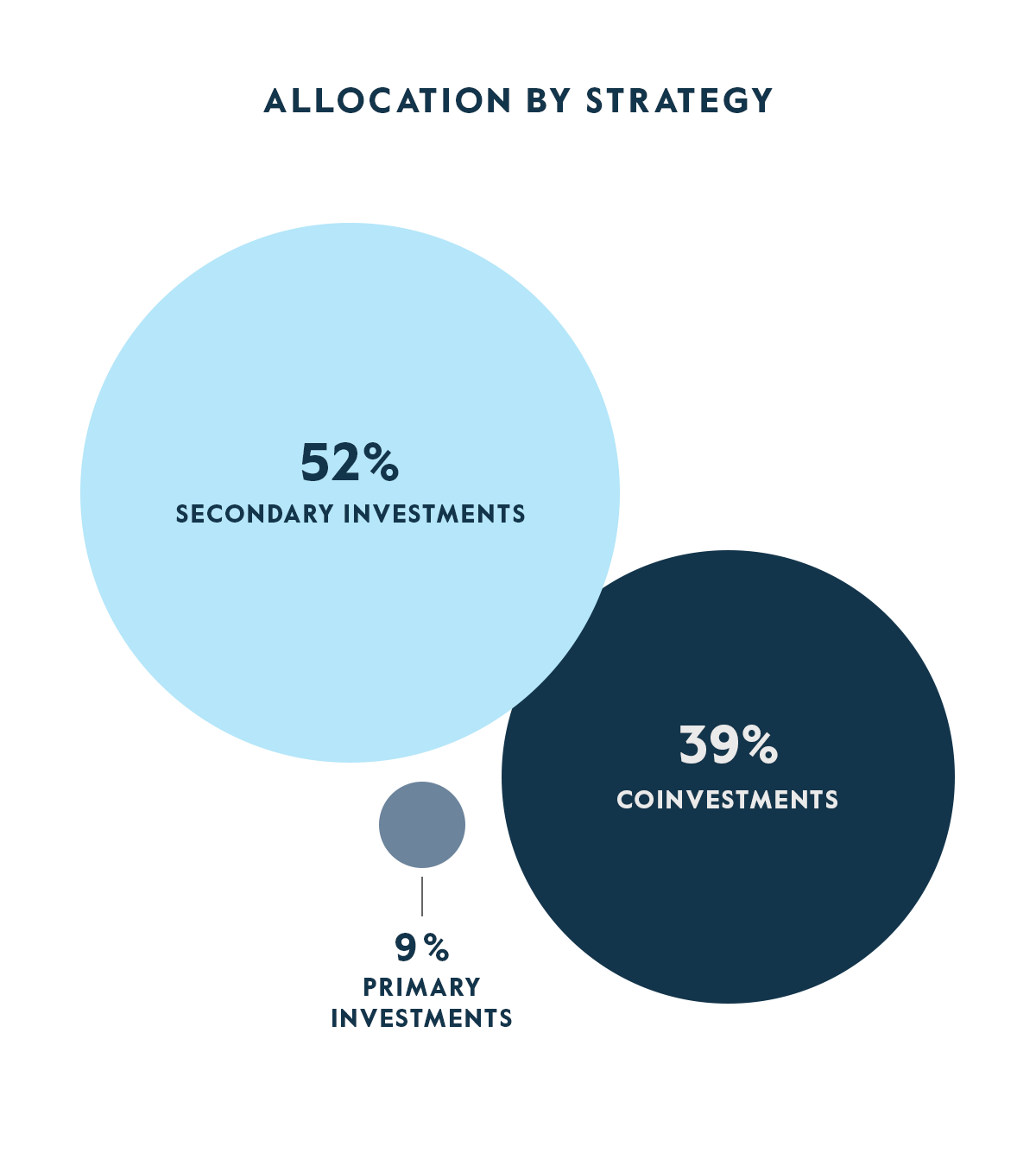

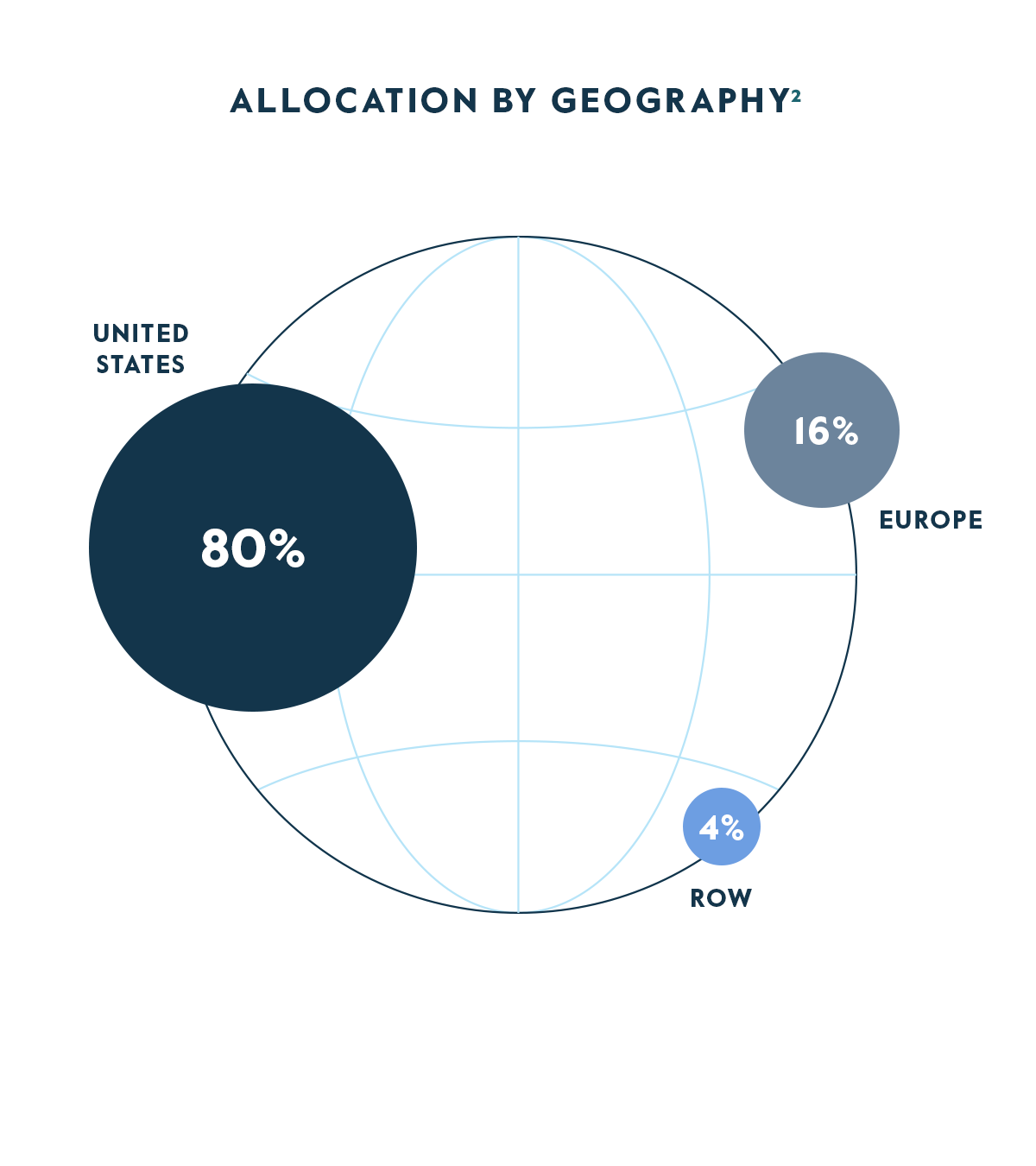

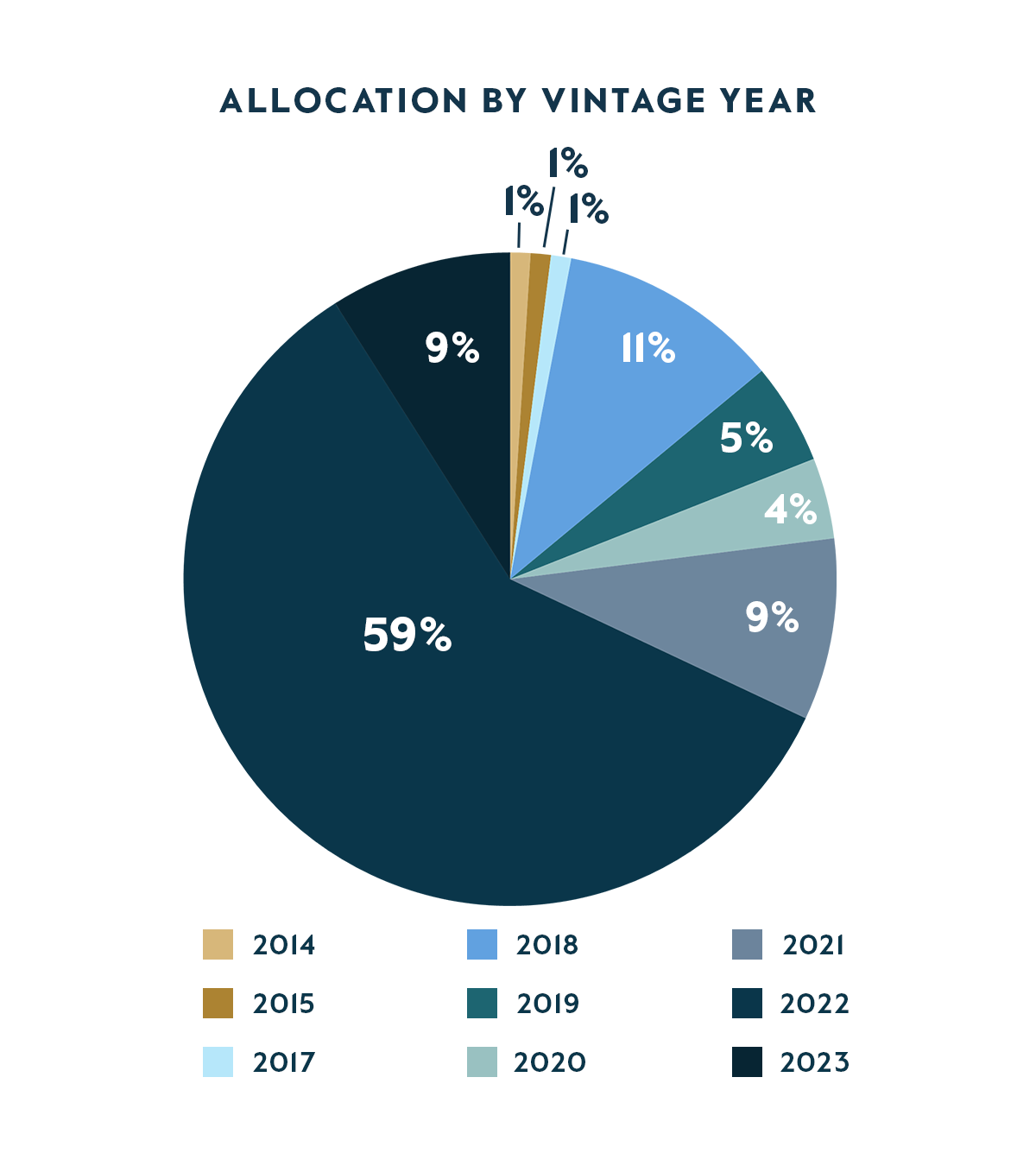

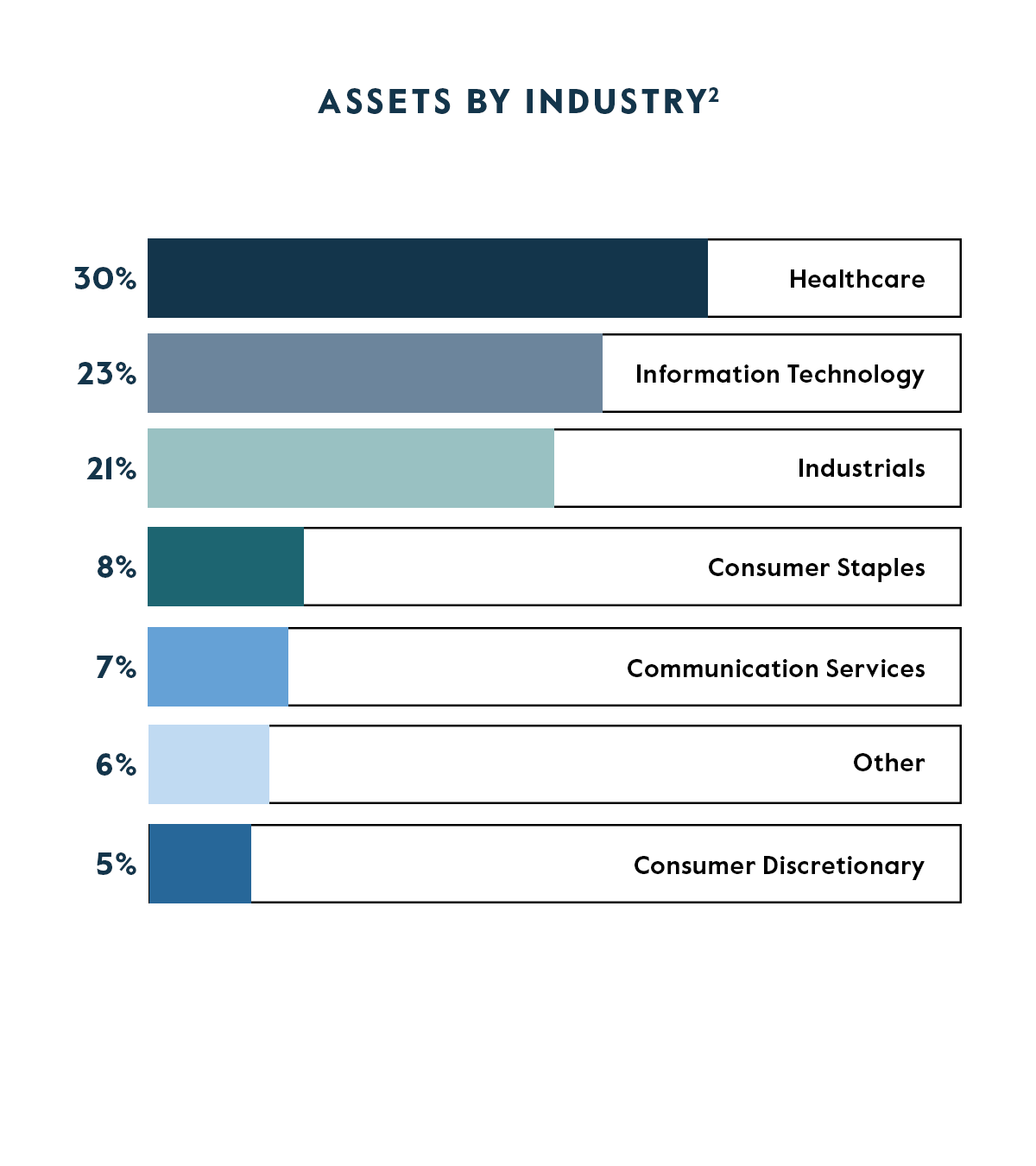

AlpInvest Portfolio Details

As of August 31, 2023.

Contact Us

For additional information, please reach out to:

Americas: Global.Wealth@carlyle.com

EMEA: CGWEurope@carlyle.com

APAC: CGWAsia@carlyle.com

Summary of Key Risk Factors

The following is a summary of the principal risks of investing in Carlyle European Tactical Private Credit Fund ("ETAC") and is qualified in its entirety by the more detailed risk factors sections in the offering document. Capitalized terms not otherwise defined herein are as defined in the offering document.

Prospective investors should be aware that an investment in ETAC involves a high degree of risk and is suitable only for those investors for whom an investment in ETAC does not represent a complete investment program, and who fully understand ETAC’s strategy, characteristics and risks, including the use of borrowings to leverage investments. An investment should only be considered by persons who can afford a loss of their entire investment. Investors should consult with their own tax and legal advisors about the implications of investing in ETAC. ETAC's shares are offered for purchase exclusively through, and subject to the terms of, its offering document. No assurance can be given that ETAC's investment objectives will be achieved or that investors will receive a return of their capital.

Liquidity Risks. ETAC is designed primarily for long-term investors. An investor should not invest in ETAC the investor needs a liquid investment. Although ETAC, as a fundamental policy, will make quarterly offers to redeem up to 5% of its outstanding Shares at NAV (less costs), the number of Shares in respect of which an application to redeem is made may exceed the number of Shares that ETAC has offered to redeem, in which case not all of your Shares tendered will be redeemed. There are also circumstances in which quarterly redemptions may be suspended as described in the offering document. Hence, you may not be able to redeem your Shares when and/or in the amount that you apply for from time to time.

In exceptional circumstances and not on a systematic basis, ETAC may make exceptions to, modify or suspend, in whole or in part, the redemption program if in the AIFM’s reasonable judgment it deems such action to be in ETAC’s best interest and the best interest of ETAC’s investors, such as when redemptions of Shares would place an undue burden on ETAC’s liquidity, adversely affect ETAC’s operations, risk having an adverse impact on ETAC that would outweigh the benefit of redemptions of Shares or as a result of legal or regulatory changes. Material modifications, including any amendment to the 5% quarterly limitations on redemptions and suspensions of the redemption program will be promptly disclosed to Shareholders. If the redemption program is suspended, the AIFM will be required to evaluate on a monthly basis whether the continued suspension of the redemption program is in ETAC’s best interest and the best interest of ETAC’s investors.

There is no current public trading market for the Shares, and it is not expected that such a market will ever develop. Therefore, redemption of Shares by ETAC will likely be the only way for you to dispose of their Shares. ETAC expects to redeem Shares at a price equal to the applicable NAV as of the Redemption Day and not based on the price at which you initially purchased their Shares. Subject to limited exceptions, Shares redeemed within one year of the date of issuance will be redeemed at 98% of the applicable NAV as of the Redemption Day. As a result, you may receive less than the price you paid for the Shares when the Shares are redeemed.

The vast majority of ETAC’s assets are expected to consist of investments that cannot generally be readily liquidated without impacting ETAC’s ability to realize full value upon their disposition. Therefore, ETAC may not always have a sufficient amount of cash to immediately satisfy redemption requests. As a result, your ability to have your Shares redeemed by ETAC maybe limited and at times they may not be able to liquidate their investment.

Potential Conflicts of Interest. There may be occasions when ETAC and its affiliates and its advisors will encounter potential conflicts of interest in connection with its activities including, without limitation, the allocation of investment opportunities and when deciding to outsource certain services required by ETAC. There can be no assurance that ETAC and its affiliates will identify or resolve all conflicts of interest in a manner that is favourable to ETAC.

Foreign Currency Risks. A significant portion of ETAC's investments (and the income and gains received by ETAC in respect of such investments) may be denominated in currencies other than the Euro. However, the books of ETAC will be maintained, and contributions to and distributions from ETAC will generally be made, in Euros. Accordingly, changes in foreign currency exchange rates and exchange controls may materially adversely affect the value of the investments and the other assets of ETAC.

Highly Competitive Market for Investment Opportunities. The activity of identifying, managing, monitoring, completing and realizing attractive investments is highly competitive and involves a high degree of uncertainty. The availability of investment opportunities generally will be subject to market conditions, and ETAC expects to encounter competition from other entities having similar or overlapping investment objectives and others pursuing the same or similar opportunities. There can be no assurance that ETAC will be able to locate, complete and exit investments that satisfy ETAC’s rate of return objective or realize upon their values or that it will be able to invest fully its available capital.

Reliance on Key Personnel. The success of ETAC depends in substantial part on the skill and expertise of Carlyle professionals, including the credit team and those currently employed or engaged by the Portfolio Manager and the Investment Adviser. There can be no assurance that the Carlyle professionals will continue to be employed by Carlyle throughout the duration of ETAC. The loss of Carlyle professionals could have a material adverse effect on ETAC.

No Assurance of Investment Return. The performance of the Shares depends on the performance of the investments of ETAC, which may increase or decrease in value. The past performance of the Shares is not an assurance or guarantee of future performance. The value of the Shares at any time could be significantly lower than the initial investment and investors may lose a portion or even the entire amount originally invested. Investment objectives express an intended result only. The Shares do not include any element of capital protection and ETAC gives no assurance or guarantee to any investors as to the performance of the Shares. Depending on market conditions and a variety of other factors outside the control of ETAC, investment objectives may become more difficult or even impossible to achieve.

Market Conditions. The success of ETAC's activities will be affected by general economic and market conditions. ETAC 's investment strategy and the availability of opportunities satisfying ETAC's risk-adjusted return parameters relies in part on observable trends and conditions in the financial markets and in some cases the improvement of such conditions. Trends and historical events do not imply, forecast or predict future events and, in any event, past performance is not necessarily indicative of future results. There can be no assurance that the assumptions made, or the beliefs and expectations currently held by ETAC's advisor will prove correct and actual events and circumstances may vary significantly.

Absence of recourse. The articles of association, the offering document and the agreements entered into by ETAC with its service providers (including the AIFM, the Portfolio Manager and the Investment Advisers) include indemnification and other provisions that will limit the circumstances under which the AIFM, the Portfolio Manager, the Investment Advisers and others can be held liable to ETAC. Additionally, certain service providers to ETAC, the AIFM, the Portfolio Manager, the Investment Advisers and their respective affiliates and other persons, including, without limitation, placement agents and finders, may be entitled to indemnification (in certain cases on terms more favourable to them than those available to indemnified parties generally). As a result, investors may have a more limited right of action in certain cases than they would in the absence of such limitations.

Use of Leverage. ETAC intends to employ leverage to achieve its investment objective and may consider other potential uses in the future. Borrowings by ETAC will further diminish returns (or increase losses on capital) to the extent overall returns are less than ETAC's cost of funds. Such debt exposes ETAC to refinancing, recourse and other risks. As a general matter, the presence of leverage can accelerate losses.

Valuation Matters. The fair value of all investments or of property received in exchange for any investments will be determined by the AIFM in accordance with the Articles of Association and the offering document. Accordingly, the carrying value of an investment may not reflect the price at which the investment could be sold in the market, and the difference between carrying value and the ultimate sales price could be material.

SFDR. It is intended that ETAC should fall within the scope of Article 8 of Regulation (EU) 2019/2088 on sustainability related disclosures in the financial services sector (“SFDR”), but ETAC does not commit to making any “sustainable investments” within the meaning of Article 2(17) of the SFDR.

Investors should carefully consider the investment objective, risks, charges and expenses of ETAC before investing. This and other important information about ETAC is in the offering document which should be read carefully before investing.

ETAC is distributed by Carlyle Global Credit Investment Management L.L.C.

Notice to the residents of EEA Members States. The marketing communication on this website are not contractually binding. Please refer to the offering document of ETAC and do not base any final investment decision on this communication alone. In relation to each member state of the EEA (each a "Member State") which has implemented the alternative investment fund managers directive (Directive (2011/61/EU)) ("AIFMD") (and for which transitional arrangements are not available), the information on this website may only be distributed and shares in ETAC may only be offered or placed in a Member State to the extent that: (1) ETAC is permitted to be marketed to professional investors in the relevant Member State in accordance with the AIFMD (as implemented into the local law/regulation of the relevant Member State); or (2) the information on this website may otherwise be lawfully distributed and the shares may otherwise be lawfully offered or placed in that Member State (including at the exclusive initiative of the investor).

Notice to the residents of Germany. The information on this website has not been verified by the German Federal Financial Supervisory Authority (Bundesanstalt Für Finanzdienstleistungsaufsicht, ("BAFIN")). The shares may only be marketed or acquired within Germany in accordance with the German Capital Investment Act (Kapitalanlagegesetzbuch, ("KAGB")) and any laws and regulations applicable in Germany governing the issue, offering, marketing and sale of the shares.

The shares are permitted to be marketed in Germany only to “professional investors” and “semi professional investors” as defined in the KAGB and the AIFMD. The shares must not be marketed in Germany, neither directly nor indirectly, to German private investors as defined in the KAGB.

Prospective German investors are strongly advised to consider possible tax consequences of an investment in ETAC and should consult their own tax advisors in that respect.

Notwithstanding the references to any compartment or fund vehicle other than ETAC or any interest in any such compartment or vehicle other than ETAC on this website, no interest other than the shares are being offered hereby to prospective German investors. To the extent that this website provides information on compartments or fund vehicles other than ETAC, such information is for investor disclosure purposes only. The interests in any such compartment or other fund vehicle must not be marketed in Germany within the meaning of § 293 para. 1 KAGB.

Notice to the residents of Italy. The information on this website and the offer of the shares of ETAC is addressed to professional investors as defined in the Italian Consolidated Law on Finance no. 58 of February 24, 1998, as amended from time to time (the “FCA”) and in the regulations of the commissione nazionale per le società e la borsa ("CONSOB") issued pursuant to it, in accordance with the framework of Directive 2014/65/EU of May 15, 2014 on Markets and Financial Instruments and Regulation (EU) No 600/2014 of May, 15 2014 on Markets and Financial Instruments. In addition to professional investors, the Shares of ETAC may be offered to the following categories of investors (collectively, “Italian Qualifying Investors”):

A. Investors who subscribe or purchase shares of ETAC for an initial, not fractionable amount of Euro 500,000;

B. Entities authorized to provide portfolio management services who, in execution of their investment mandate, subscribe or purchase shares of ETAC for an initial amount of not less than Euro 100,000 on behalf of a retail investors; and

C. Investors who subscribe or purchase shares of ETAC for an initial, not fractionable amount of Euro 100,000, provided that the following two conditions jointly apply: (i) the investor’s commitments in alternative investment funds reserved to professional investors do not exceed the 10% of the aggregate investor’s financial portfolio; and (ii) the investor is making the commitment on the basis of the investment advice received from an entity duly licensed to provide such services.

The addressee acknowledges and confirms the above and hereby agrees not to circulate The information on this website in Italy unless expressly permitted by, and in compliance with, applicable law.

In addition, any investor will be required to agree and represent that any on-sale or offer of any share by such investor (in accordance with ETAC's documents) shall be made in compliance with all applicable laws and regulations.

Notice to the residents of Monaco. Shares in ETAC may not be offered or sold, directly or indirectly, to the public in Monaco other than by an authorised intermediary. The information on this website, which has not been submitted to the Clearance Procedure of the Monegasque Authorities, including the Commission de Contrôle, nor any offering material relating to the placement of shares in ETAC, may be released or issued to the public in Monaco in accordance with any such offer. The information on this website does not constitute an offer to sell securities under the Securities Laws of Monaco.

Notice to the residents of Switzerland. The information on this website does not constitute a prospectus pursuant to the Collective Investment Schemes Act dated 23 June 2006 as amended (the "CISA") or the Financial Services Act dated 15 June 2018 as amended (the "FinSA") and may not comply with the information standards required thereunder. The shares in ETAC will not be listed on the SIX Swiss Exchange or another Swiss Exchange and consequently the information presented on this website does not necessarily comply with the standards set out in the relevant listing rules.

The documentation of ETAC has not been approved by the Swiss Financial Market Supervisory Authority ("FINMA") for distribution to non-qualified investors. ETAC only can be offered to Institutional and Professional Investors within the meaning of Art. 4 (3)-(5) FINSA. The information on this website may only be used by those persons to whom it has been delivered in connection with the shares of ETAC and may neither be copied, directly/indirectly distributed, nor made available to other persons. The information on this website does not constitute investment advice.

Switzerland – location where the relevant documents may be obtained

The offering document, the articles of association as well as the annual reports and other shareholder reports may be obtained free of charge from the Swiss representative from the representative.

Switzerland – payment of retrocessions and rebates

ETAC and its agents do not currently pay any retrocessions to third parties as remuneration for distribution activity in respect of shares in or from Switzerland.

ETAC and its agents may, upon request, pay rebates or their equivalent directly to investors. The purpose of rebates is to reduce the fees or costs incurred by the investor in question.

Rebates are permitted provided that:

A. They are paid from fees received by ETAC and therefore do not represent an additional charge on ETAC assets;

B. They are granted on the basis of objective criteria; and

C. All investors who meet these objective criteria and demand rebates are also granted these within the same timeframe and to the same extent.

The objective criteria for the granting of rebates are as follows:

A. The size of the investor's commitment to ETAC; or

B. Investing by first close.

For additional information please refer to the offering document. At the request of the investor, ETAC must disclose the amounts of such rebates free of charge.

Switzerland – place of performance and jurisdiction

In respect of the Shares offered in Switzerland, the place of performance is the registered office of the representative. The place of jurisdiction is at the registered office of the representative or at the registered office or place of residence of the investor.