Sustainable Growth

Jeanologia

Reducing Water and Chemical Usage in Denim Processes

We track ESG data so that we can make better investment decisions and build better, more sustainable businesses. Carlyle Europe Partners is in its fourth year of tracking material, bespoke ESG key performance indicators (KPIs) across its portfolio companies, which has led to even more use cases than we originally envisioned. Last year we profiled one of those companies, Jeanologia, a Valencia, Spain-based portfolio company at the forefront of sustainable and eco-efficient technologies for manufacturing denim, which focuses on significantly reducing the amount of water and chemical usage in finishing processes. Jeanologia tracks a series of material ESG KPIs that range from energy management to employee health and safety.

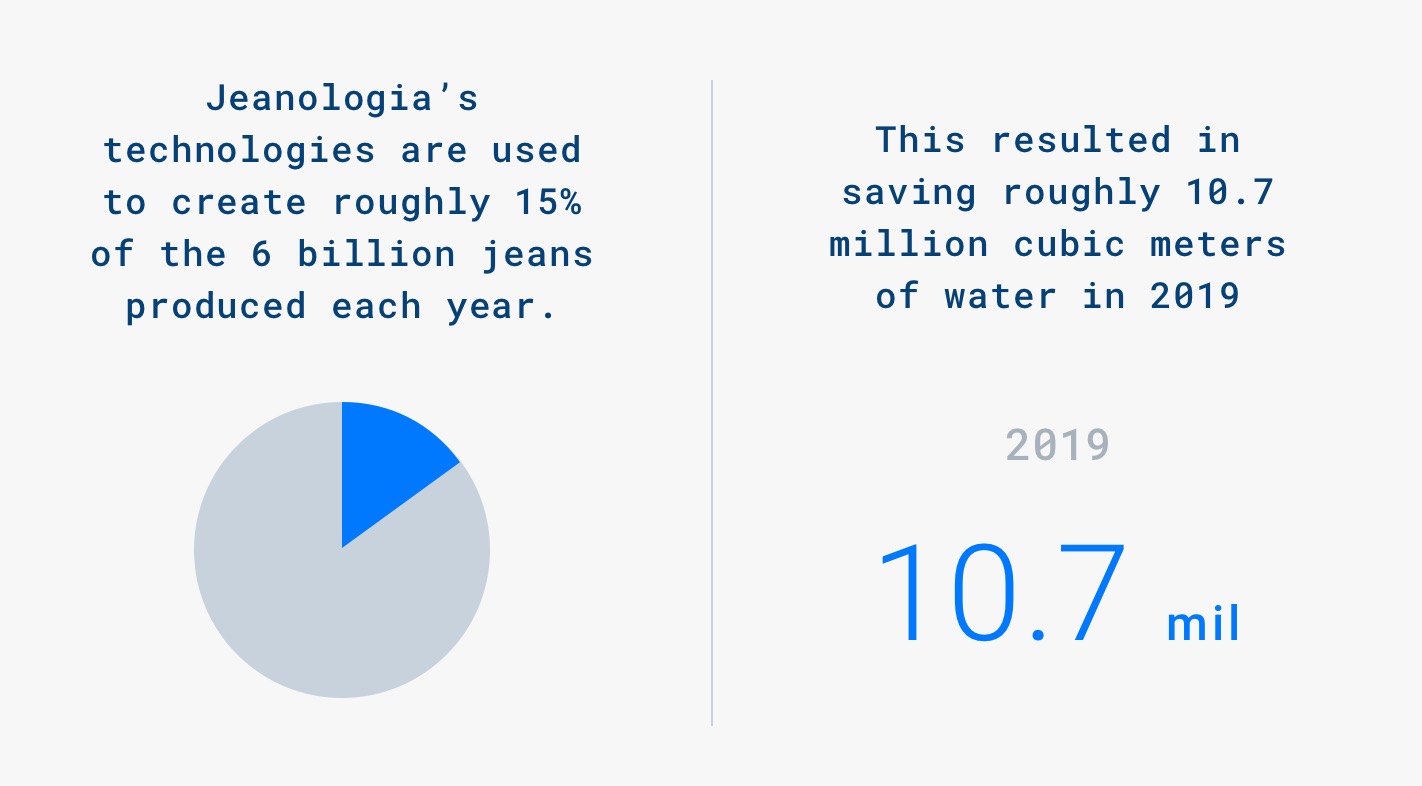

Critically, Jeanologia tracks water reduction from using their technologies for denim finishing. This metric is material to the business, because it drives costs savings and business efficiencies, on top of the environmental benefits. Jeanologia’s technologies are used to create roughly 15% of the 6 billion jeans produced each year. This resulted in saving roughly 10.7 million cubic meters of water in 2019. This data has also been critical from a revenue perspective, as consumer preferences increasingly favor sustainably-produced goods and services. As Carlos Robles, a Director on the Carlyle Europe Partners team part of the CEP advisory team notes, “today’s consumer is focused on the environmental footprint of fashion choices, and demands brands and retailers produce clothes that reflect this concern – this approach has always been part of Jeanologia’s mission.”

Jeanologia’s ESG data also played a critical role in its financing. In December of 2019 Jeanologia completed an ESG-linked term loan, thought to be the first European sponsored transaction with pricing on the funded debt liked directly to specific ESG criteria – in this case, annual water savings. The margin Jeanologia pays on the debt decreases if it meets its annual water savings targets, while pricing increases if the target is missed by 15% or more.

“Today’s consumer is focused on the environmental footprint of fashion choices, and demands brands and retailers produce clothes that reflect this concern – this approach has always been part of Jeanologia’s mission.”

-Carlos Robles, Director on the Carlyle Europe Partners team and part of the CEP team

“We have demonstrated our conviction in Jeanologia’s sustainable business model by taking one particular KPI - annual water saving - and directly linking it to the cost of third party debt financing for the transaction” said Sam Lukaitis, Director of Carlyle’s Global Capital Markets team. “In doing so, we are delighted to have structured one of the very first green financings for the European leverage finance market.”

ESG data continues to evolve – and so do its use cases. By focusing on material, performance-based ESG KPIs, Jeanologia demonstrates how sustainability can drive a financial edge, on top of environmental benefits.

Carlyle believes these selected case studies should be considered as a reflection of Carlyle’s investment process, and references to these particular portfolio companies should not be considered a recommendation of any particular security, investment, or portfolio company. The information provided about these portfolio companies is intended to be illustrative, and is not intended to be used as an indication of the current or future performance of Carlyle’s portfolio companies. The investments described in the selected case studies were not made by any single fund or other product and do not represent all of the investments purchased or sold by any fund or other product. The information provided in these case studies is for informational purposes only and may not be relied on in any manner as advice or as an offer to sell or a solicitation of an offer to buy interests in any fund or other product sponsored or managed by Carlyle or its affiliates. Any such offer or solicitation shall only be made pursuant to a final confidential private placement memorandum, which will be furnished to qualified investors on a confidential basis at their request.