5 Questions for 2023

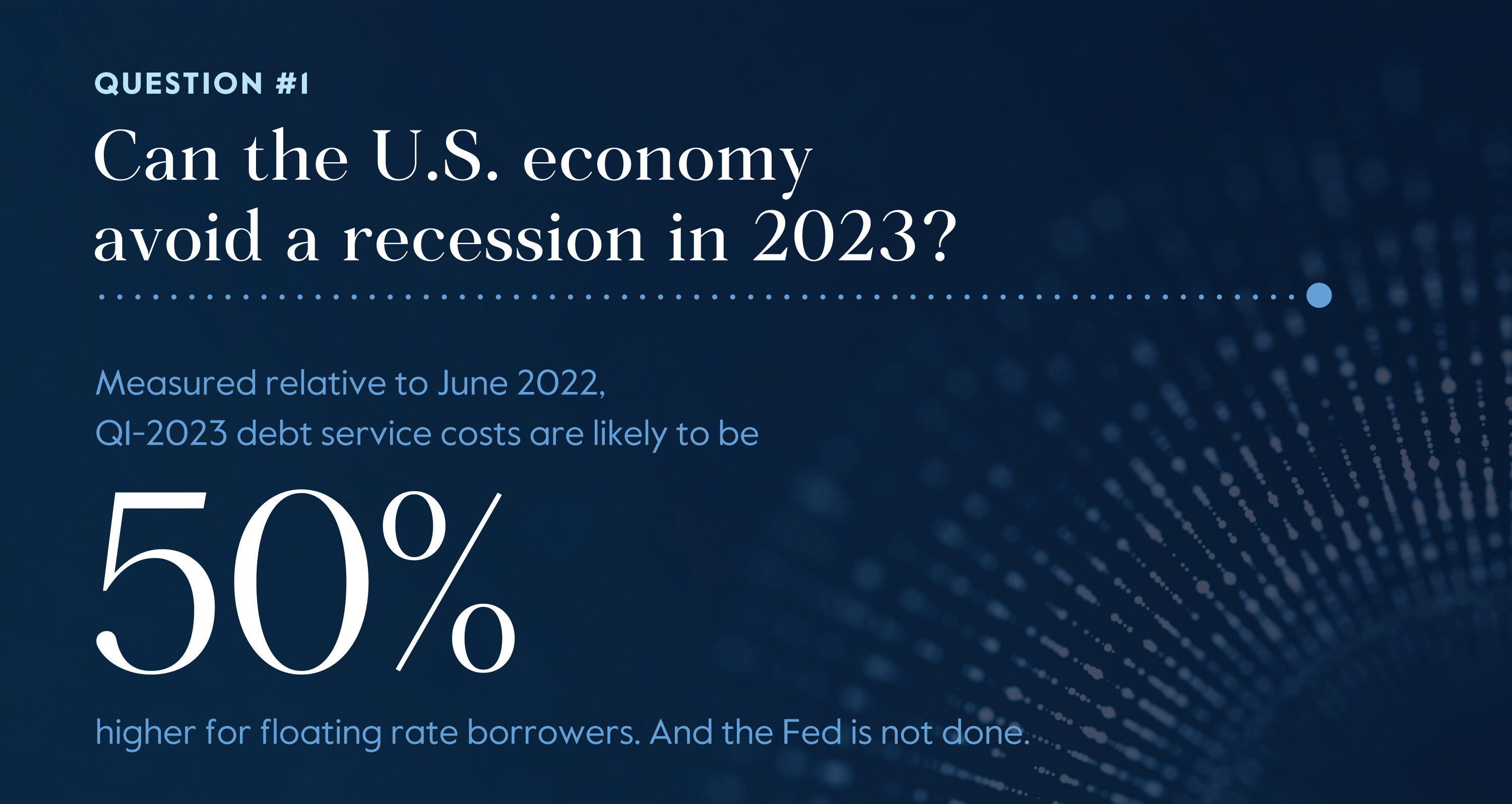

If 2022 was the year of the “policy boomerang,” 2023 seems likely to bring the long-awaited adjustment in real activity.

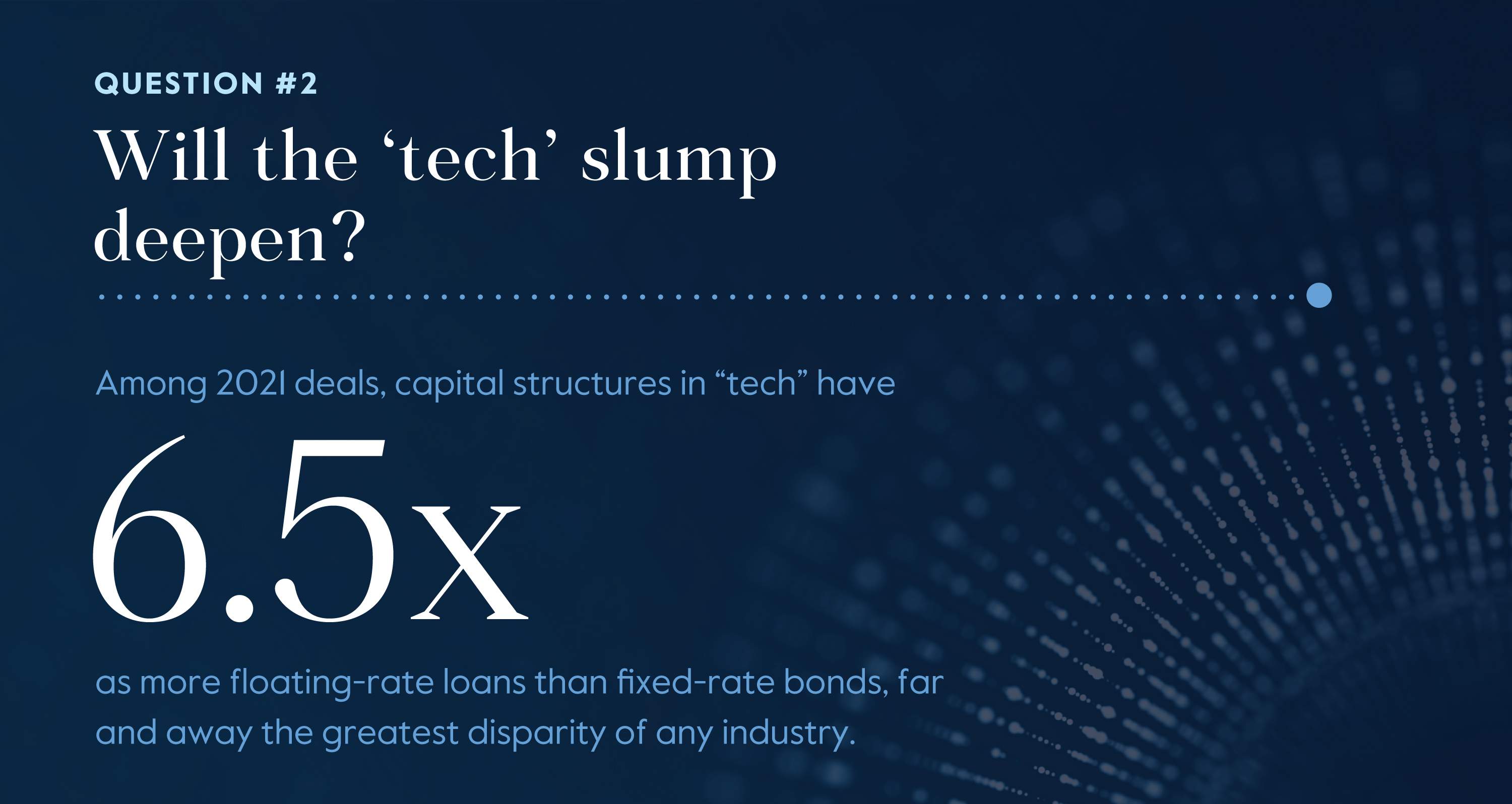

With the lowest interest coverage ratios and highest share of floating rate debt in the U.S. economy, the tech sector again looks likely to bear the brunt of higher interest rates. Much of the rest of the economy should weather the storm relatively well, with many management teams eager to boost capex and build more robust logistics and production networks.

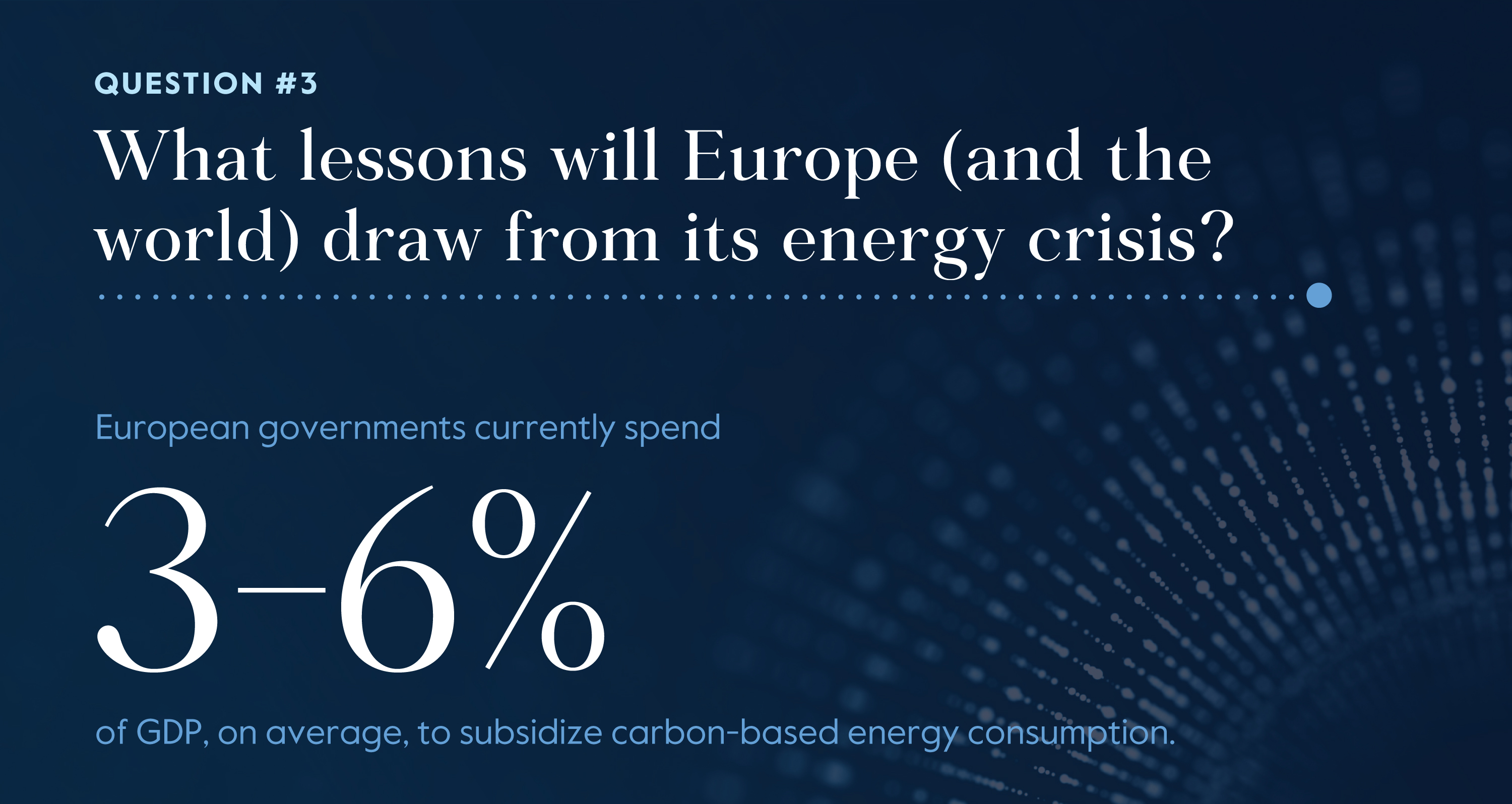

China’s emergence from “Zero Covid” seems likely to be similarly focused on resilience and self-sufficiency, with more investment (re)directed towards science and technology. Policy shifts may also become apparent in Europe, where the economy has performed far better than many feared largely because of a policy response to energy shortages that raises difficult questions about the efficacy of past efforts to reduce carbon emissions.

Overall, 2023 could be a year that crystallizes the importance of diversification and risk management in the minds of investors singularly focused on upside, as portfolios (over)weighted towards pandemic-era winners take on more water.

Our latest report from our Head of Global Research Jason Thomas examines five global macroeconomic questions for investors to consider in the year ahead. Review the key themes Jason highlights in the report and download the full report below.

5 Questions for 2023

Source: Calculated based on the Q4-2022 International Money Market (IMM) benchmark, which increased from 1.2% in June 2022 to 4.32% in December 2022. Assuming a 500bps credit spread, the increase would be 50%. The lower the spread, the greater the percentage increase in financing costs.

Source: S&P LCD and BAML Data, December 2022.

Source: Bruegel, November 2022. There is no guarantee any trends will continue.

Source: National Health Commission, Cited in Bloomberg, “China Estimates Covid Surge Is Infecting 37 Million People a Day,” December 23, 2022.

Source: “U.S. Remains ‘Only Game in Town’ for Stock Investors,” Wall Street Journal, November 21, 2022.

Read 5 Questions for 2023 by Jason Thomas

ABOUT THE EXPERT

Jason Thomas is the Head of Global Research at Carlyle, focusing on economic and statistical analysis of Carlyle portfolio data, asset prices and broader trends in the global economy.

Prior to joining Carlyle, Mr. Thomas served on the White House staff as Special Assistant to the President and Director for Policy Development at the National Economic Council. In this capacity, Mr. Thomas acted as the primary adviser to the President for public finance.

Mr. Thomas received a BA from Claremont McKenna College and an MS and PhD in finance from George Washington University, where he studied as a Bank of America Foundation, Leo and Lillian Goodwin Foundation, and School of Business Fellow.

Mr. Thomas has earned the chartered financial analyst designation and is a Financial Risk Manager certified by the Global Association of Risk Professionals.