Who We Are

Our Firm

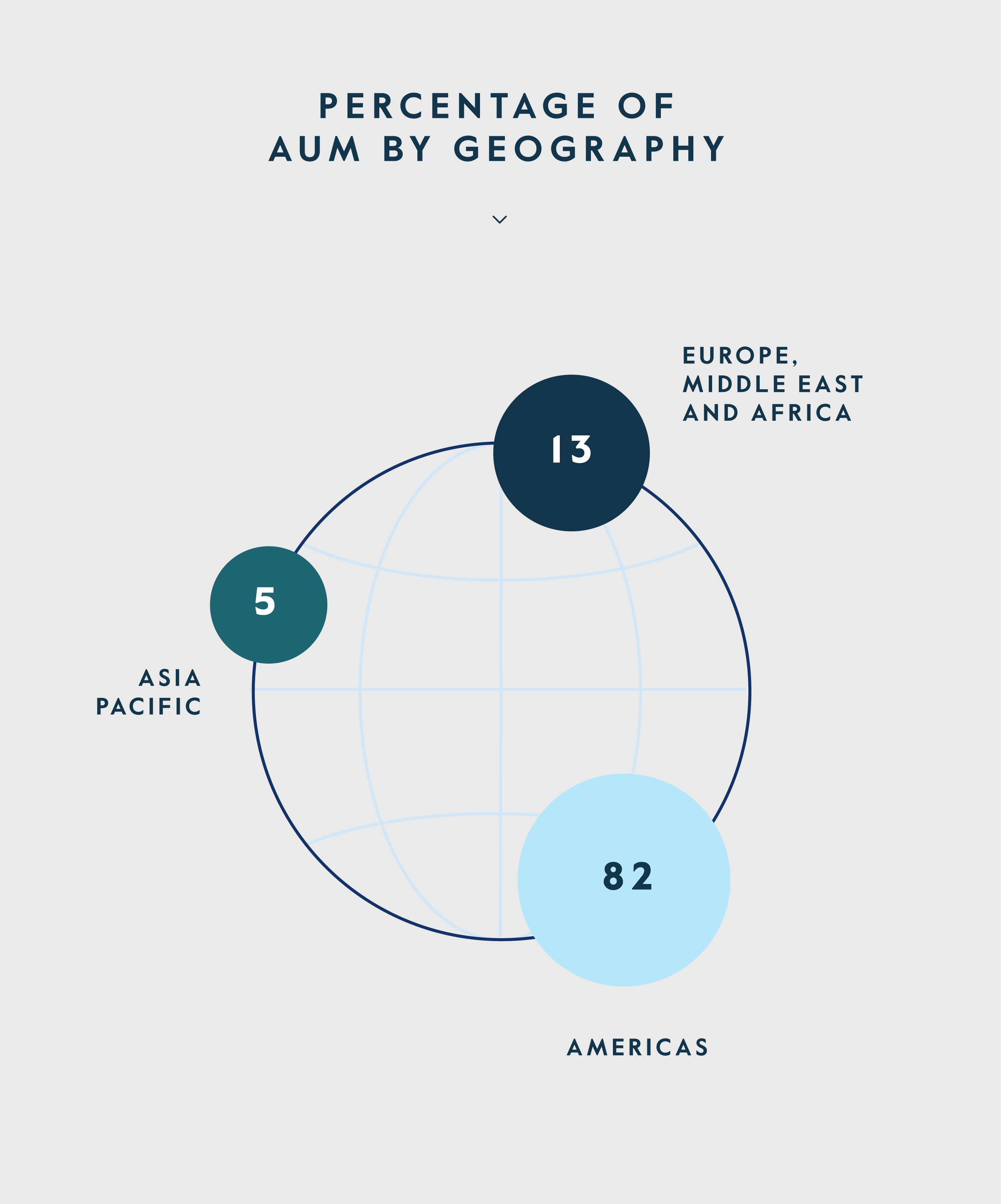

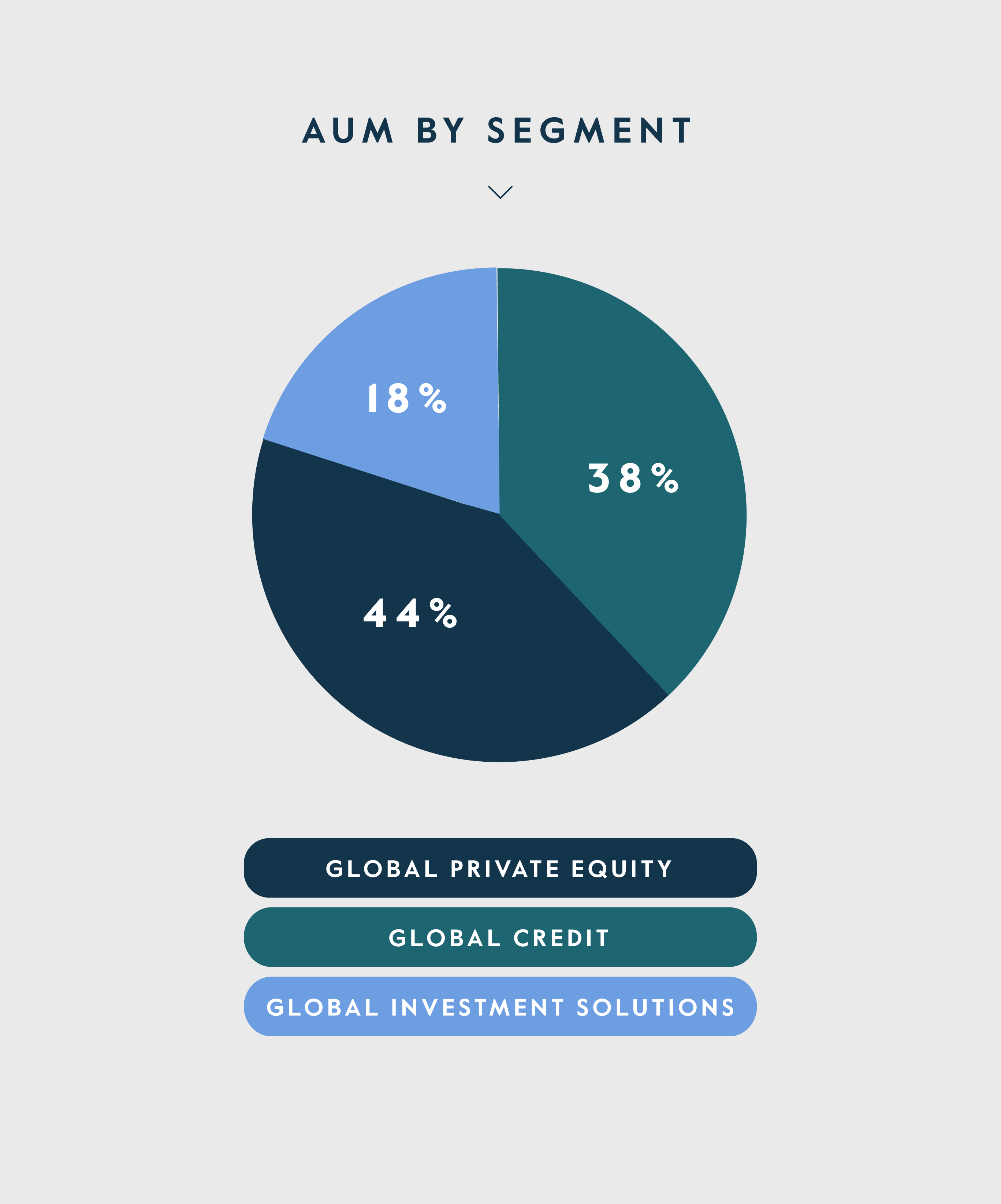

Carlyle is one of the world’s largest and most diversified global investment firms, with $426 billion of assets under management across 3 business segments and 585 investment vehicles. Founded in 1987 in Washington, DC, our global team today is comprised of more than 2,200 professionals operating in 28 offices across 4 continents. Together, across our firm, our mission is to drive long-term value for our investors, companies, shareholders, people and communities.

Our Business Segments

Our People

Our team makes us unique. The strength of our team is essential to our success.

Our Approach

Since our founding over 30 years ago, we have always looked to create lasting partnerships across all of our businesses. We work with our partners to find solutions that drive sustainable value and impact over the long term. We have built trust and credibility by leveraging our global scale, industry expertise and diverse insights to deliver better solutions and build better businesses. By approaching every investment with our full platform, we uncover new opportunities, transform businesses and foster innovation.

The Carlyle Advantage

As a leader in the industry, we’ve developed a formula for success that brings our full platform to every interaction and transaction. The combination of our global reach, industry expertise and diverse teams allow us to maintain our competitive advantage and partner with great management teams to build better businesses and make an impact.

Carlyle by the Numbers

As one of the world’s largest investment management firms, our assets are diversified across our business segments as well as the industries, sectors and regions in which we invest.