Video file

OUR THOUGHT LEADERSHIP

Global Insights

We consistently provide global insights on industries and markets to help build better portfolios, businesses and communities.

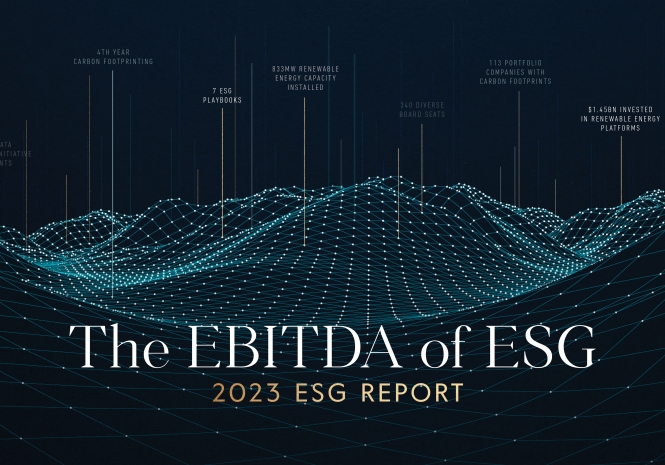

The EBITDA of ESG

We are pleased to share this year’s ESG report, entitled “The EBITDA of ESG” to reinforce our belief that integrating ESG factors into our investment processes provides an additive lens that we believe can provide opportunities for our portfolio companies to drive revenues, reduce costs, secure more efficient financing, and strengthen their competitive positioning.