CTAC

Carlyle Tactical Private Credit Fund

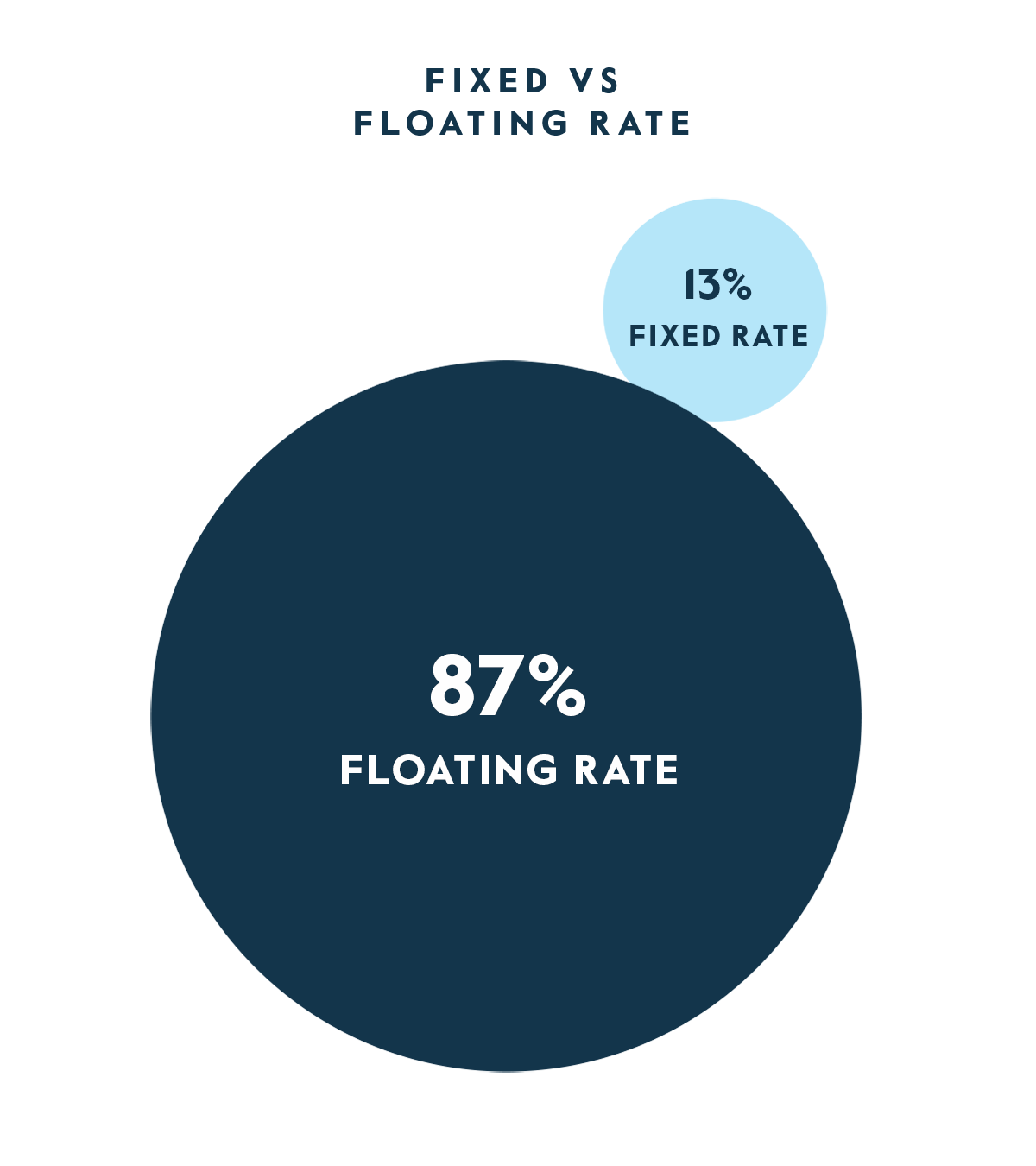

Carlyle Tactical Private Credit Fund (“CTAC”) is a continuously offered, unlisted closed-end investment company that is structured as an interval fund. CTAC leverages Carlyle’s Global Credit platform and seeks to provide access to a wide array of private credit strategies to meet its objectives of delivering current income. Under normal circumstances, the Fund will invest at least 80% of its assets in private fixed income securities and credit instruments.

As of December 31, 2023, Carlyle's Global Credit platform manages $188 billion of credit assets. The group's investment strategies span the credit spectrum: liquid credit, private credit and real assets credit.

The Fund materials below must be preceded or accompanied by a prospectus, which is the exclusive offering document for CTAC. By proceeding, you acknowledge you have reviewed the prospectus. If not, a prospectus can be obtained here. Please review the following summary of risk factors, as well as the prospectus, for a full list of risks associated with investing in the Fund before making any investment decision.

We believe private credit belongs as a staple within a well-diversified portfolio, driving enhanced yield to investors through market cycles. Through CTAC, we are excited to provide access to the breadth and expertise of our entire credit platform.

|

Justin V. Plouffe Deputy Chief Investment Officer for Global Credit |

Key Fund Facts

June 2018Fund Inception | $3,936MM1Total Assets Under Management | 10.37% / 10.38%2Annualized/ LTM Distribution Rate |

708Number of Holdings | 0.593Portfolio Duration | 21.4%4Leverage |

1 Total AUM as of 2/29/24 represents total assets under management including leverage (net assets of $2,910mm). Past performance does not guarantee future results.

2 As of 3/31/24 based on N share class. Represents income, capital gains and return of capital (if any) in the stated reporting period. Annualized distribution rate is calculated by taking the stated quarter’s distribution rate divided by the quarter-end NAV and annualizing, without compounding. Last Twelve Months “LTM” distribution rate is calculated by taking the total distribution rate over the period divided by the current quarter-end NAV.

3 Duration (Years) on Assets: Duration measures interest rate sensitivity; the longer the duration, the greater the volatility as rates change.

4 Level of Debt and Preferred Equity as a Percent of Total Assets Under Management.

Quarterly Distribution Info as of 3/31/24

| Dividend Quarter | CARLYLE TACTICAL PRIVATE CREDIT FUND CLASS I |

|---|---|

| 3/31/2024 | $0.21 |

| Dividend YTD | $0.21 |

Performance as of 4/24/24

| Ticker | NAV | MTD Return | QTD Return | YTD Return | ITD Return (Cumulative) | One Year | Three Years (Annualized) | ITD Return (Annualized) |

|---|---|---|---|---|---|---|---|---|

| TAKIX | $8.58 | 0.66% | 0.66% | 3.79% | 38.74% | 13.22% | 7.77% | 5.97% |

| Date | Ticker | NAV | MTD Return | QTD Return | YTD Return | ITD Return (Cumulative) | One Year | Three Years (Annualized) | ITD Return (Annualized) |

|---|---|---|---|---|---|---|---|---|---|

| 4/24/24 | TAKIX | $8.58 | 0.66% | 0.66% | 3.79% | 38.74% | 13.22% | 7.77% | 5.97% |

| 4/23/24 | TAKIX | $8.57 | 0.52% | 0.52% | 3.65% | 38.55% | 13.13% | 7.72% | 5.95% |

| 4/22/24 | TAKIX | $8.57 | 0.49% | 0.49% | 3.61% | 38.50% | 13.09% | 7.72% | 5.94% |

| 4/19/24 | TAKIX | $8.56 | 0.35% | 0.35% | 3.47% | 38.32% | 13.20% | 7.70% | 5.93% |

| 4/18/24 | TAKIX | $8.56 | 0.29% | 0.29% | 3.41% | 38.23% | 13.16% | 7.68% | 5.92% |

| 4/17/24 | TAKIX | $8.57 | 0.38% | 0.38% | 3.50% | 38.36% | 13.30% | 7.72% | 5.94% |

| 4/16/24 | TAKIX | $8.57 | 0.36% | 0.36% | 3.48% | 38.33% | 13.30% | 7.71% | 5.94% |

| 4/15/24 | TAKIX | $8.57 | 0.34% | 0.34% | 3.46% | 38.30% | 13.27% | 7.71% | 5.94% |

| 4/12/24 | TAKIX | $8.57 | 0.32% | 0.32% | 3.44% | 38.27% | 13.63% | 7.80% | 5.94% |

| 4/11/24 | TAKIX | $8.57 | 0.26% | 0.26% | 3.37% | 38.19% | 13.59% | 7.78% | 5.93% |

| 4/10/24 | TAKIX | $8.57 | 0.24% | 0.24% | 3.35% | 38.16% | 13.73% | 7.78% | 5.93% |

| 4/9/24 | TAKIX | $8.57 | 0.22% | 0.22% | 3.33% | 38.13% | 13.72% | 7.78% | 5.93% |

| 4/8/24 | TAKIX | $8.57 | 0.20% | 0.20% | 3.31% | 38.10% | 13.70% | 7.78% | 5.93% |

| 4/5/24 | TAKIX | $8.57 | 0.17% | 0.17% | 3.29% | 38.07% | 13.79% | 7.83% | 5.94% |

| 4/4/24 | TAKIX | $8.57 | 0.11% | 0.11% | 3.22% | 37.99% | 13.62% | 7.81% | 5.93% |

| 4/3/24 | TAKIX | $8.57 | 0.09% | 0.09% | 3.20% | 37.96% | 13.62% | 7.81% | 5.93% |

| 4/2/24 | TAKIX | $8.57 | 0.07% | 0.07% | 3.18% | 37.92% | 13.83% | 7.81% | 5.92% |

| 4/1/24 | TAKIX | $8.57 | 0.05% | 0.05% | 3.16% | 37.90% | 13.81% | 7.81% | 5.92% |

Past Performance is no guarantee of future results. Performance information has been rounded to the nearest cent and difference between the performance of share classes may accordingly appear larger or smaller than an investor could expect to be the case over time. Total returns assume reinvestment of all dividends, capital gain and return of capital distributions, if any, and does not include a sales charge or deduction of any taxes. NAV = NAV Per Share, MTD = Month to Date, QTD = Quarter to Date, YTD = Year to Date and ITD = Inception to Date. Annualized Total Return is calculated by taking the cumulative Total Return for the respective period and annualizing, inclusive of compounding. Past performance is no guarantee of future results. Annual Expense Ratios: Gross expenses are higher in certain share classes due to low share class assets. Annual Expense Ratios: Gross: Class A shares 6.67% / Class I shares 6.16% / Class L shares 6.69% / Class M shares 6.91% / Class N shares 6.15% / Class U shares 6.87% / Class Y shares 6.41%. Net: Class A shares 6.73% / Class I shares 6.32% / Class L shares 6.81% / Class M shares 6.96% / Class N shares 6.22% / Class U shares 6.88% / Class Y shares 6.48%. The Net Annual Expense Ratios exceed the Gross Annual Expense Ratios for certain share classes as a result of recoupment of previously reimbursed expense waivers. The Adviser and the Fund have entered into the Expense Limitation Agreement under which the Adviser has agreed contractually for a one-year period ending April 30, 2024. The performance data quoted represents past performance, which does not guarantee future results. Current performance and expense ratios may be lower or higher than the performance data quoted. The investment return and principal value of an investment in the fund will fluctuate so that an investor’s shares, when repurchased, may be worth more or less than the original cost. For performance data current to the most recent month-end, visit www.CarlyleTacticalCredit.com or call 833-677-3646. Class Y, N, M, and Class I shares are not subject to a sales charge. The net expense ratio takes into account contractual fee waivers and/ or reimbursements, without which performance would have been less. These undertakings may not be amended or withdrawn for one year from the date of the current prospectus, unless approved by the Board. Generally, Class A Shares and Class L Shares are offered through Financial Intermediaries on brokerage or transactional platforms. Class Y, M, N Shares and Class I Shares are generally available through fee-based programs, registered investment advisers and other institutional accounts. Generally, Class I shares can only be purchased with a $250,000 initial investment. See prospectus for details. In April 2020, the Fund was required to switch from OFI's valuation policy to Carlyle' valuation methodology ("Bid vs. Mid").

Portfolio Details

As of February 29, 2024 and subject to change.

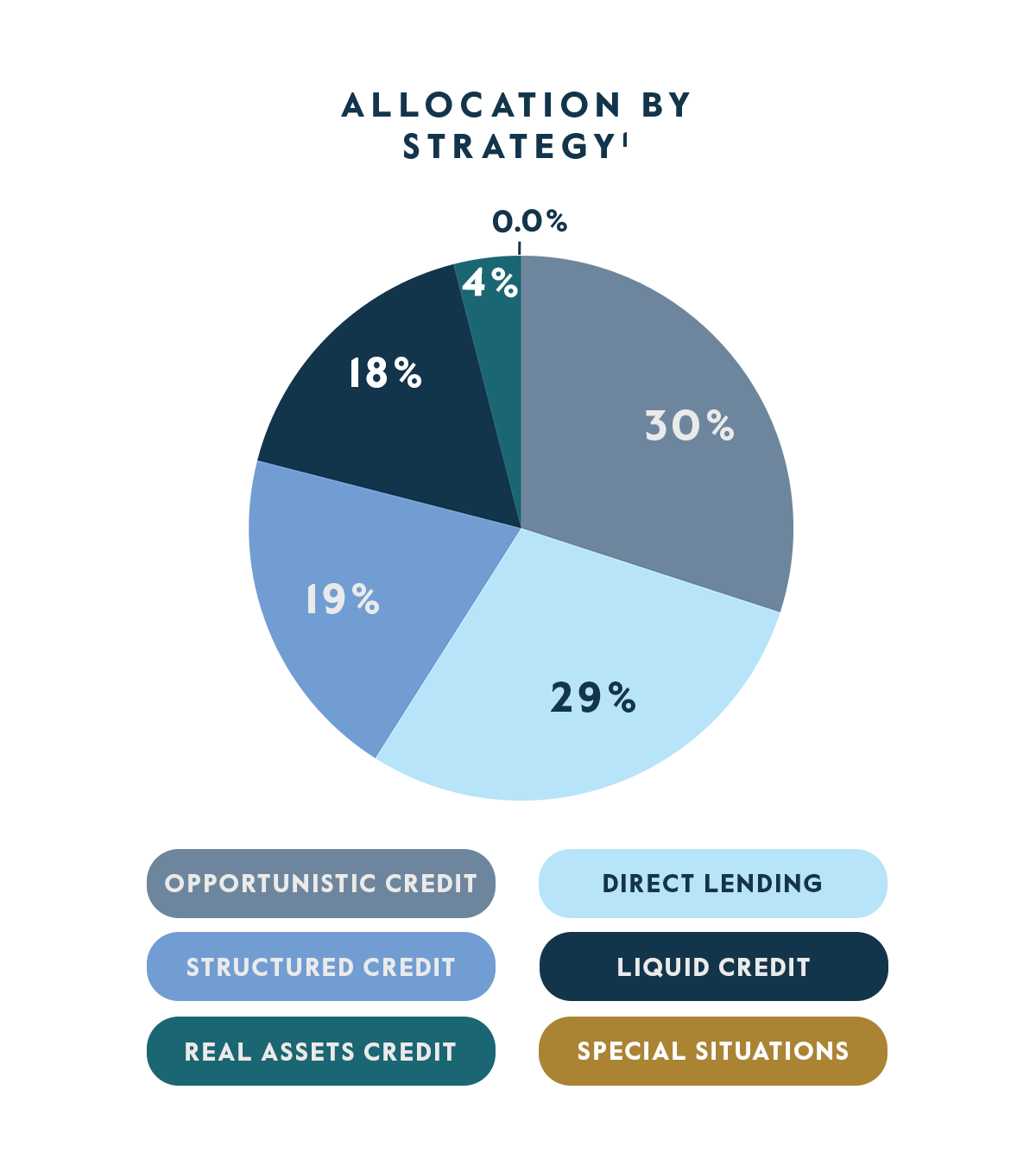

1 The strategy allocation percentages set forth represent actual portfolio allocations. There can be no assurance that any investment process or strategy will achieve its objectives. Excludes cash and cash equivalents.

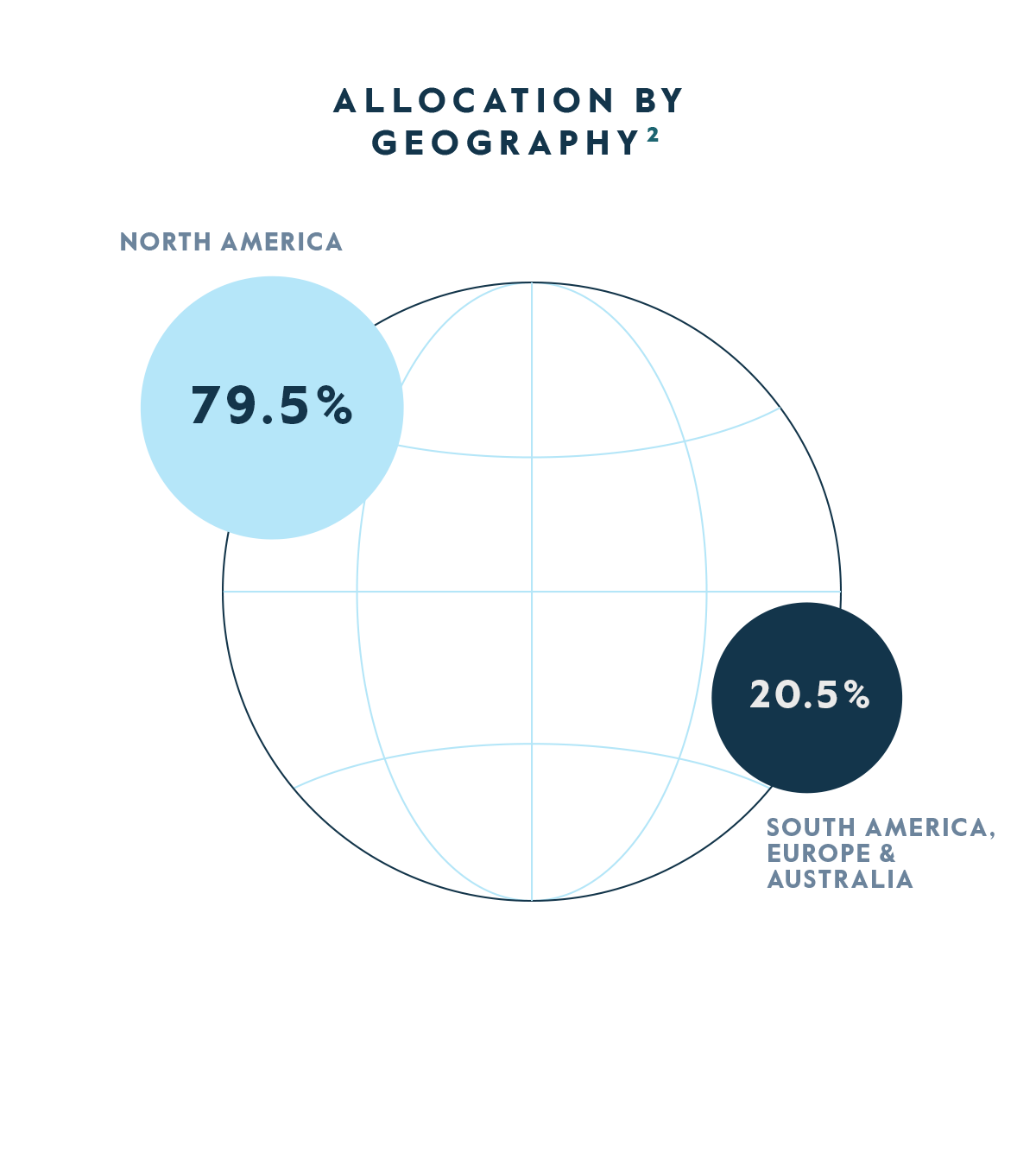

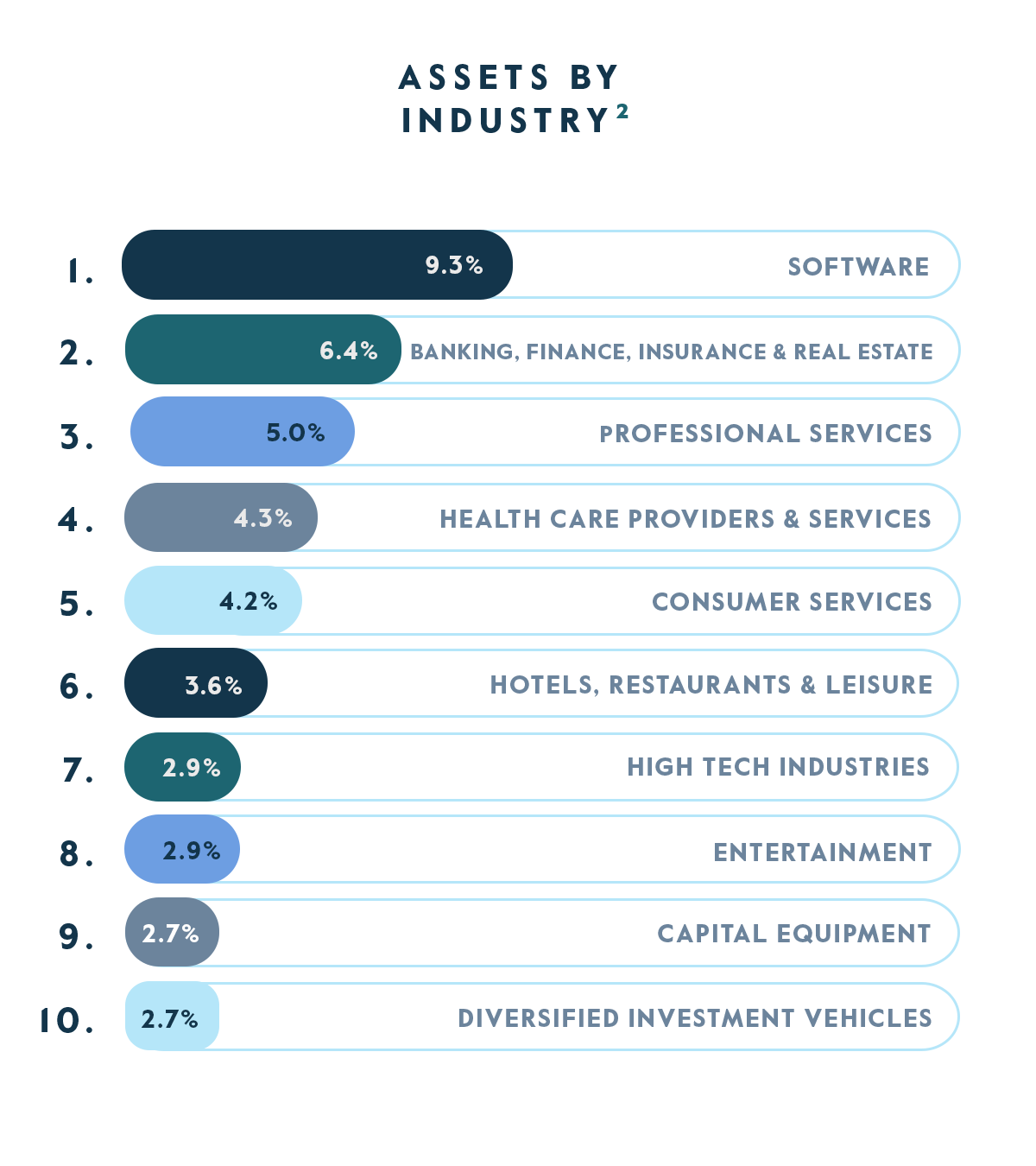

2 The mention of specific sectors, countries, securities or issuers does not constitute a recommendation on behalf of the fund or the Advisor.

Materials

| Marketing Documents | Offering Materials | Financial Information |

|---|---|---|

To check the background of the Firm or investment professionals, visit brokercheck.finra.org.

For a link to the Funds Ownership filings, please click here.